List of Best Banks in Plot Financing in Kenya

When looking for plot financing in Kenya, several banks offer competitive loan products specifically designed to help individuals purchase land.

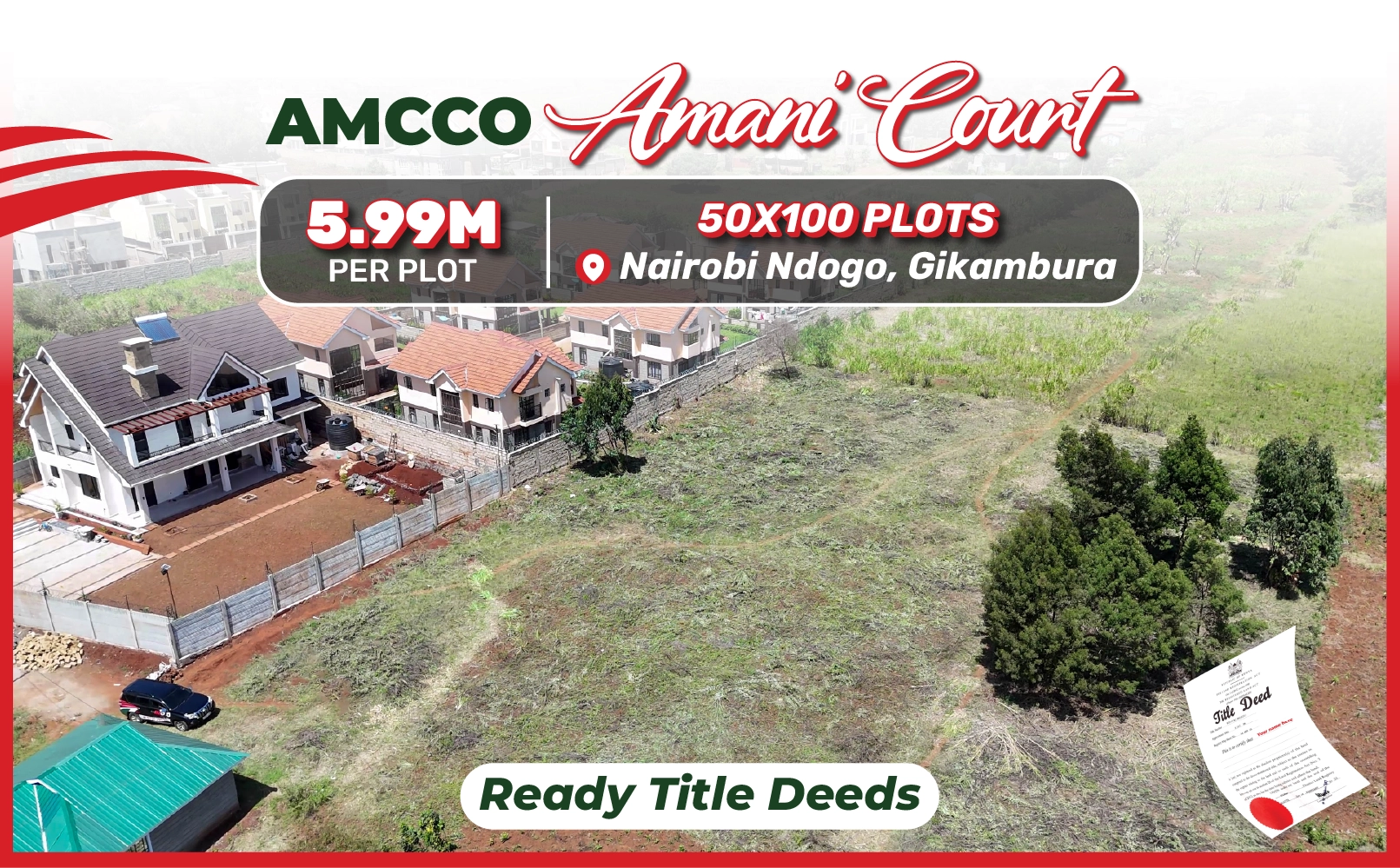

It is also important to identified real estate firms that accept bank financing like AMCCO Properties Limited in Kikuyu.

Here are some of the best banks for plot financing in Kenya.

1. KCB Bank Kenya

Kenya Commercial Bank (KCB) offers plot loans for the purchase of residential, commercial, and agricultural land. Their financing covers up to 70% of the plot's value with flexible repayment periods of up to 48 months.The application process is straightforward, and they offer competitive interest rates. KCB also provides pre-approval services and advisory on the suitability of the land being purchased.

2. Equity Bank Kenya

Equity Bank provides plot financing for individuals and groups looking to purchase land for various purposes. They finance up to 80% of the plot's value with repayment terms ranging from 12 to 60 months.Equity Bank is known for its personalised customer service and flexible loan terms. They offer quick loan processing and insurance options to cover the loan.

3. Co-operative Bank of Kenya

Co-operative Bank offers loans for the purchase of plots within designated areas. They finance up to 80% of the plot's value with a maximum repayment period of 48 months. Their competitive interest rates and flexibility in repayment make them a popular choice.Co-op Bank also provides additional services such as legal and valuation fees financing within the loan package.

4. Stanbic Bank Kenya

Stanbic Bank offers plot loans to customers looking to purchase land for investment, residential, or agricultural purposes. They finance up to 70% of the plot value, with a repayment period of up to 60 months. Stanbic Bank is known for its efficient loan processing and favorable interest rates.They provide advisory services to help clients choose suitable plots and handle the legal aspects of the purchase.

5. Absa Bank Kenya

Absa Bank offers financing for the purchase of residential and commercial plots. They cover up to 70% of the plot value, with repayment periods ranging from 12 to 48 months.

Absa Bank is recognised for its transparent loan terms and competitive interest rates.

The bank also provides clients with a dedicated relationship manager to assist throughout the loan process.

6. NCBA Bank Kenya

NCBA offers plot financing for individuals and groups looking to purchase land for various uses. They finance up to 75% of the plot's value, with repayment terms up to 60 months. NCBA is known for its tailored loan solutions and competitive interest rates.

The bank also offers pre-approval services and personalized loan packages based on the client's needs.

7. Family Bank Kenya

Family Bank is known for its customer-centric approach and flexible loan terms. They provide loans for the purchase of plots, covering up to 70% of the plot's value with repayment terms of up to 48 months.

The bank also offers advisory services and facilitate the legal and valuation process as part of the loan package.

8. I&M Bank Kenya

The I&M Bank offers plot financing for individuals and corporate clients looking to purchase land. They finance up to 70% of the plot's value with a repayment period of up to 60 months.

They provide comprehensive advisory services and support throughout the loan application and disbursement process.

These banks offer a variety of plot financing options to suit different needs, whether you're purchasing land for residential, commercial, or agricultural purposes. It's essential to compare the terms, interest rates, and additional services offered by each bank to find the best fit for your needs.

It is equally important to identify real estate firms that accept bank financing without subjecting clients to unnecessary demands and bureaucratic procedures.

AMCCO Properties Limited is a trusted partner that accepts bank financing to give clients a variety of payment options when buying land.

Amcco properties has all projects with ready individual title deeds, therefore, we accept bank and sacco financing. We also help clients in accessing this facilities

check our available plots for financing: https://amccopropertiesltd.co.ke/properties

For more information, contact AMCCO Properties Limited today via 0701 293 199.