How to get Loans for Plots and Vacant Land in Kenya

Land in Kenya is not anywhere close to cheap. Land Purchases require huge budgets unlike other products in the market and at times raising the amount in due time can be a constraint.

This however should not distract you from your dreams of investing in land since there are multiple financial solutions at your disposal.

The most popular solution is Asset financing offered by banks.

They are suitable and preferred as potential aids when making land purchases.

Banks offer financial loans and grants based on your relationship with them and membership duration.

In this blog we explain all the A-Z of acquiring a bank loan to ensure you purchase that land of your interest despite your current budget.

1.The Best Bank

Kenya has over 28 domestic and 14 foreign banks operating to serve the 56 million Kenyans interested in financial services.

The quality of loan you can get from any bank is often based off your relationship and membership with them.

When it comes to loan acquisition for land purchases, you should reach out to your specific bank and enquire about the application process, terms and other important details.

Overall the best bank to borrow a loan from is based on your preference amongst the above-mentioned factors. Some banks don’t offer loans for purchasing land therefore only select the ones that do.

Here are some popular loan programs from Kenyan banks;-

Commercial Bank of Kenya Plot Purchase

2.Requirements and Qualification for Loan Eligibility

For you to be eligible for a loan in Kenya you must;

Be 18 years and above

Have a National ID Number

Posses a registered phone number

Have a valid account and account number with the lending bank

The next stage is usually the most competitive as it determines whether you get the land-purchasing loan or not.

After passing eligibility stage, now comes in the qualification process whereby your bank will request you to provide;

a) For the Employed

Pay slips (often 3 months plus)

KRA Pin

Collateral (A valued item that the bank can seize when you default the loan repayment)

A guarantor/joint application with a credit worthy cosigner.

6 months bank statements.

Letter from your employer (request varies with the lending bank)

b) For the Self Employed

KRA Pin

Audited Financial records (for the past 3 business years)

1 year bank statements

Other important business support documents

You should be well prepared with all necessary qualifications to successfully pass that stage.

Important Note; -Even though you are eligible and qualify for a loan, most banks will not give you one if you are purchasing land from individuals.

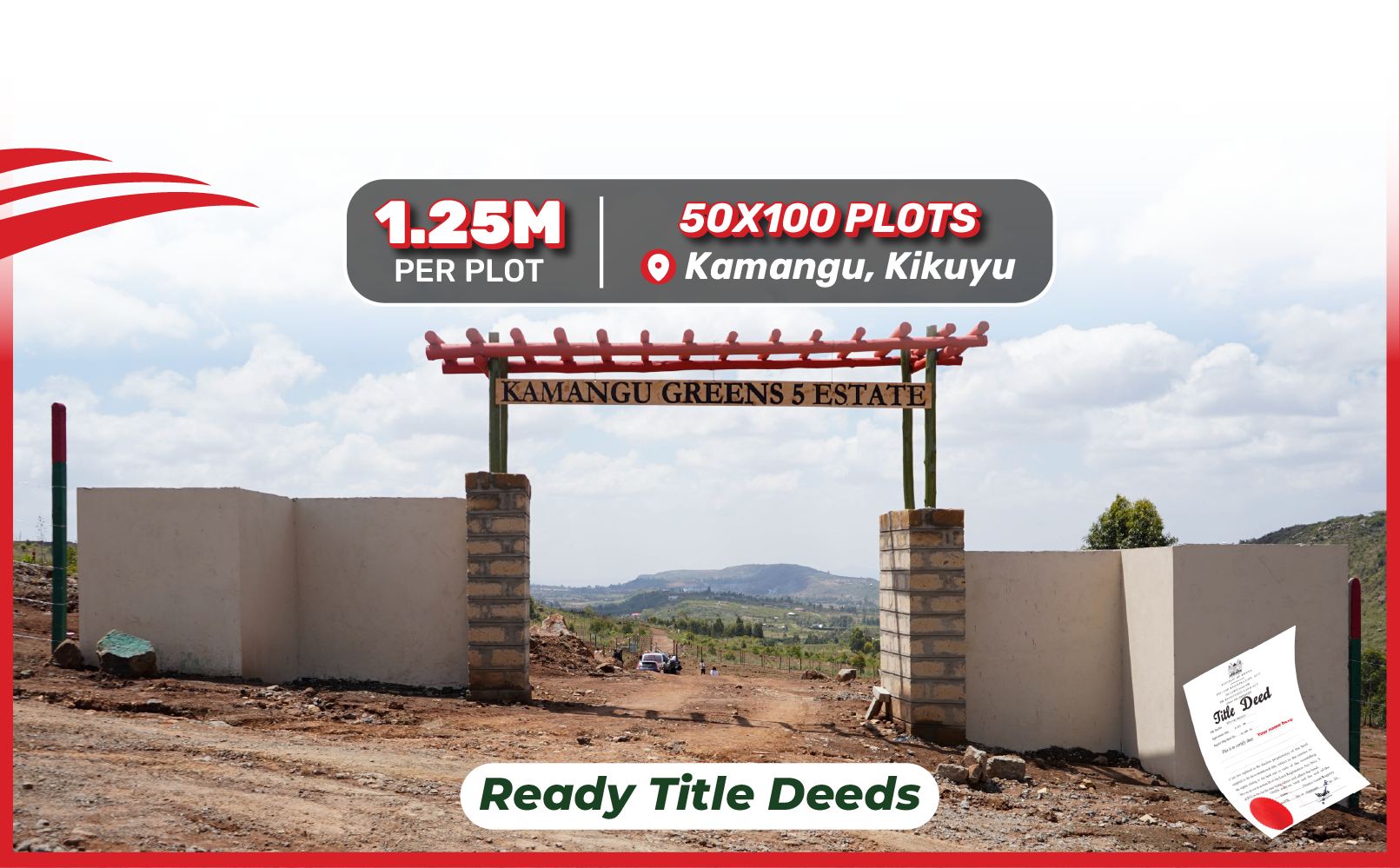

The only way you acquire the loan is by purchasing from legitimate real estate companies like Amcco Properties Limited.

3.Loan Application and Grant Process

DID YOU KNOW?

Eligibility and qualification aren’t enough when borrowing land-purchasing loans. More often banks will request the following for them to approve your loan request; –

Title deed to conduct land searches to prove ownership.

Valuation by their evaluators to find the actual land value

Thereafter, the loan is approved under various terms majorly;

The Title Deed holds the Bank’s name or together with your name until you fully repay the loan

The land purchased stands as collateral for your Loan.

The amount to be issued will be based on your credit score and financial history at the bank.

4.Payment Process, Terms and Conditions

Every bank has its set of terms and conditions that guide you while applying and receiving a loan.

If and when you go against them, disciplinary actions will be taken based on your agreement with the bank.

A wise investor should carefully read and confirm the terms before requesting for a loan to avoid collateral issues.

The bank always issues a valid and reasonable duration for you to pay back the loan and once fully paid the Title Deed is transferred to read under your name and details.

It’s that easy, right? Therefore when you ready to purchase land using the asset financing method, will we be at your service with the best high value land in Nairobi Metropolis area.