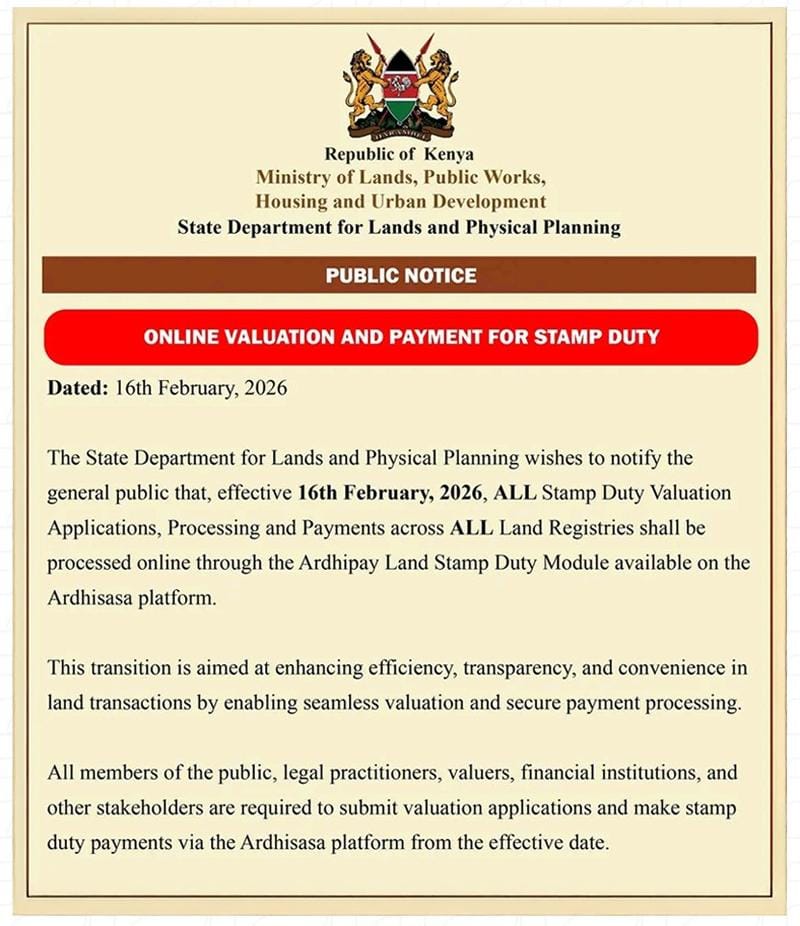

In February 2026, Kenya’s Ministry of Lands launched the National Stamp Duty Module (NSDM) via the Ardhisasa system. This platform digitizes stamp duty payments, reducing manual errors, fraud, and delays, while ensuring faster title issuance.

For buyers and investors, NSDM means transparent, real-time transactions, and aligns with the way AMCCO Properties Ltd manages all-inclusive property pricing, giving clients confidence in their investment.

What Is NSDM and Why It Matters

The NSDM integrates valuation, self-assessment, invoicing, and digital payment in one platform. Land transactions outside the module are now invalid, emphasizing compliance.

Benefits for buyers include:

Instant digital receipts

Reduced queues at registries

Enhanced fraud protection

Clear, predictable costs

Step-by-Step Guide to Paying Stamp Duty on Ardhisasa

Follow this simple workflow for transfers, leases, or property charges:

Register/Login

Create an account with ID and KRA PIN.Access Stamp Duty Module

Navigate to “Stamp Duty Self-Assessment” in the invoicing dashboard.Enter Property Details

Include county, parcel number, land size, transaction type, and parties’ KRA PINs.Generate Invoice

NSDM calculates duty automatically:Urban leasehold: 4%

Rural freehold: 2%

Pay Digitally

Options include M-Pesa, bank transfer, or card. Instant receipts are issued.Download Confirmation

Franked documents are ready for registry submission.

Freehold vs Leasehold: How NSDM Applies

Both tenure types are covered:

Freehold: Perpetual ownership, mostly rural areas, 2% duty

Leasehold: Government-granted term, mostly urban, 4% duty

The digital process is identical for both. Lease renewals or rents may include separate land rent.

Hidden Costs Buyers Often Miss

Purchasing land involves more than the plot price:

Stamp duty

Legal fees

Transfer costs

Valuation and search fees

Many buyers underestimate these, which can add up to hundreds of thousands of shillings.

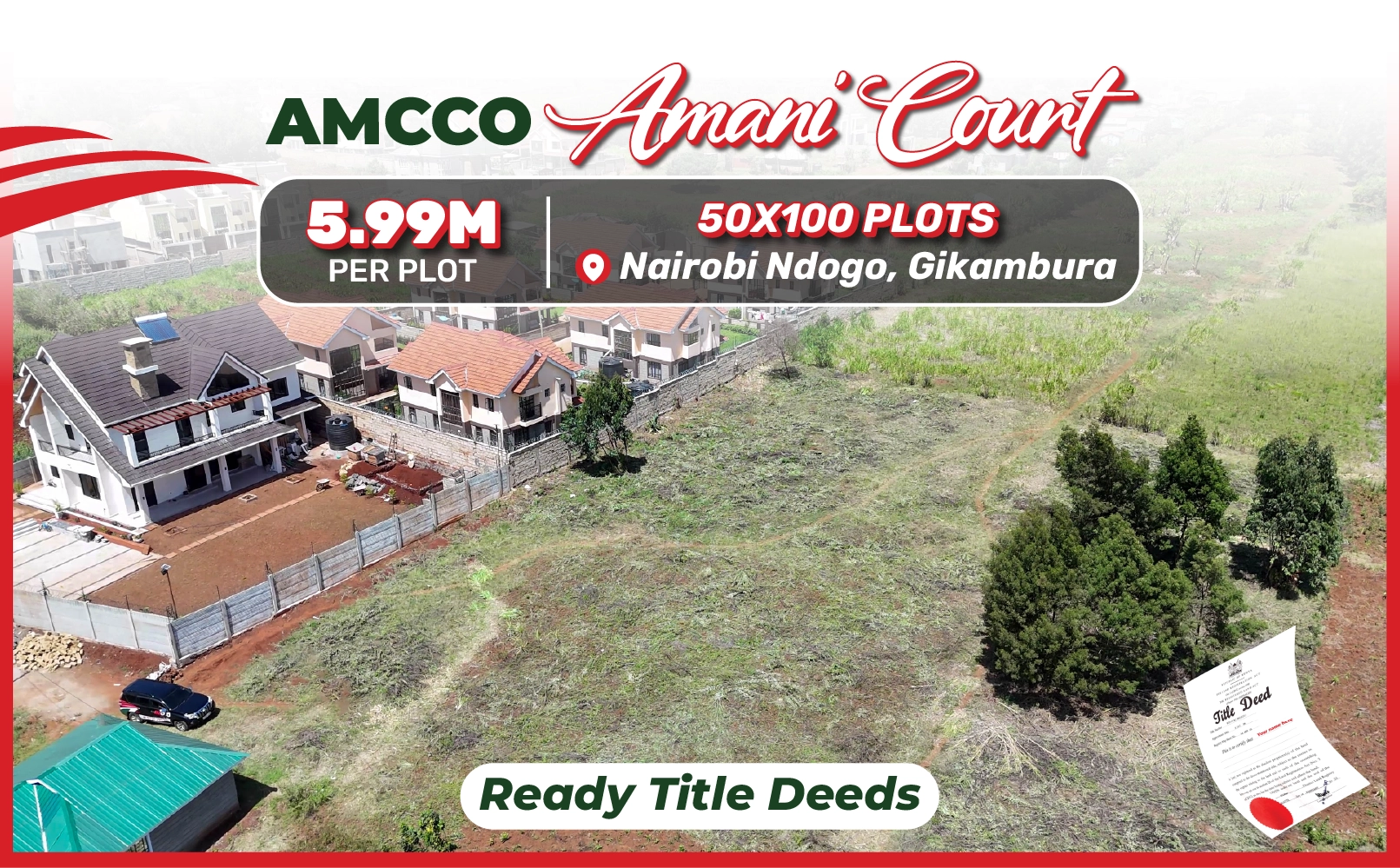

How AMCCO Properties Makes It Easy

At AMCCO Properties Ltd, all-inclusive pricing ensures:

Stamp duty included

Legal and transfer costs covered

Title deed issuance included

No hidden charges mean buyers know the exact investment from day one.

Tips for Smooth Land Transactions

Verify the Title: Confirm legitimacy and registration.

Understand Your Tenure: Freehold or leasehold. All land AMCCO sells is freehold.

Budget for Total Costs: Unless buying from all-inclusive sellers like AMCCO.

Use NSDM Early: Start the digital process promptly.

Conclusion

Kenya’s NSDM digitizes land transactions, making them faster, transparent, and fraud-proof. Buyers working with AMCCO Properties Ltd enjoy peace of mind with all-inclusive pricing, ready titles, and expert guidance, ensuring a smooth and compliant land purchase experience in 2026.

FAQs (Voice Search Optimized)

Q: What is the National Stamp Duty Module (NSDM)?

A: It’s a digital platform via Ardhisasa for stamp duty assessment, payment, and confirmation.

Q: Is stamp duty mandatory for all land transfers?

A: Yes, all land transactions in Kenya must use National Stamp Duty Module as of February 2026.

Q: How much stamp duty do I pay?

A: 2% for rural/freehold and 4% for urban/leasehold properties.

Q: Are fees included when buying from AMCCO Properties?

A: Yes, all levies, title processing, and legal fees are included in AMCCO’s all-inclusive pricing.

.jpg)