4 Benefits Of Owning Land As A Chama

In modern times, especially right now when the economy is not easier, land has been commercialized to form a key aspect of economic development. Both the public and private sectors have shown great interest in land banking and infrastructural development.Organized social investment groups, famously known as Chamas, have an opportunity to benefit from land ownership.

Below are some of the benefits that chamas benefit from investing in land:

By positioning itself to gain from land banking earnings, a chama can increase its capital base and improve the lives of its members.

Significant ROI (return on investment):

The Global Property Guide Kenya states that residential real estate is becoming more valuable.

Because housing costs will soar as a result, a Chama will see enormous returns on their rental property.

They can simply divide the monthly income they receive from investing in apartments among themselves or use it to expand their group through other initiatives they may decide to put up.

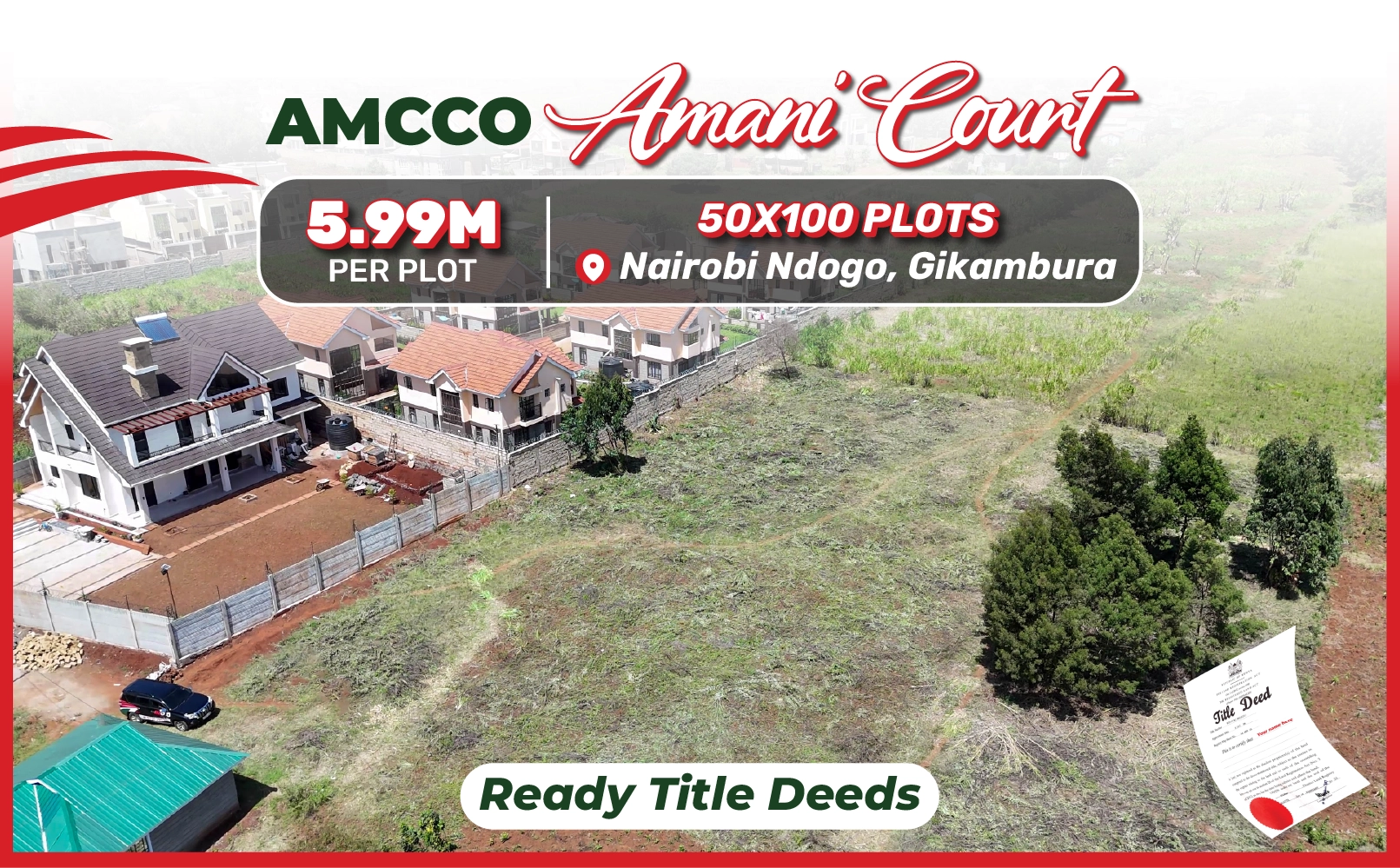

Easy Accessibility to Key Amenities

Some property providers ensure that their clients are availed of the very best; thus, by giving them easily accessible roads to their properties, ensuring that there’s electricity on site, perimeter walls as well, playing fields, and learning institutions, amongst many other things, you see, this is an added advantage that they initially didn’t have but will now have.

They Get an Opportunity to Speculate

The Chama, or group of people, would have the option of purchasing land, holding it to accrue value, and then considering selling it afterwards when its value has appreciated.

A Chama may position itself to benefit from the profits of land banking, hence growing its capital base to transform the lives of its members.

They get to enjoy after-sale benefits

A Chama will see to it that post-purchase services are provided to its members.

Services like title transfer, project and property management, and project management are provided by a reputable real estate firm.

In essence, an after-sale service is support provided by a business to its customers following their purchase of a good or service. This promotes recommendations and word-of-mouth advertising while also solidifying the bond between consumers and brands.

Title deeds act as collateral

A group title deed may be used to access bank loans as collateral, thereby increasing the financial bargaining power of groups.

A title deed can act as collateral for a loan, which means that the lender can sell the property if the borrower fails to repay the loan.

Quite a number of lenders in Kenya accept title deeds as collateral.